- Microsoft money plus sunset deluxe payment of invoices software#

- Microsoft money plus sunset deluxe payment of invoices download#

Microsoft money plus sunset deluxe payment of invoices software#

(4) Roll with the punches – when you overspend this month, the software will indicate you will have to cut your spending the following month. (2) Give every dollar a job – kind of like zero-based budgeting (1) Stop living paycheck to paycheck – work towards saving enough firstly to sustain on the previous month’s income However, if you are looking at a better budgeting software, you should check out You Need A Budget ( ), and especially the four rules of budgeting: īasically I like the PearBudget spreadsheet because it is simple and free.

Microsoft money plus sunset deluxe payment of invoices download#

The authors now have a web-version ( and reviewed at ) that costs a bit of money, while one can still download the free spreadsheet here: and reviewed at. Like it a lot, primarily because it’s free. Hi Martin, a topic that I really love myself too! I’ve been using the PearBudget’s spreadsheet for couple of years already. If you like to try out Microsoft Money to monitor your personal finances, you can download them at the links below: The download worked even if you did not have a previous version of Microsoft Money installed on your computer. It is designed as a replacement product for expired versions of the Money line of products. What personal financial software do you use?Ībout a month ago, Microsoft released a downloadable sunset version of the Microsoft Money products. I know most people probably use excel for simplicity. It still works fine so maybe I will just stick with it. So now, I’m still stuck with Microsoft Money. I wanted to buy it but it’s not even available for sale in Singapore (nor from their website)!Īn opensource GnuCash looked interesting as it uses double entry accounting for tracking but the data migration from Microsoft Money looked to be a nightmare. Quicken is probably one of Microsoft Money’s greatest competitor. Some of these were really good as the data can be streamed directly from the bank accounts to the service providers so there is minimum data entry required.Ĭan’t find something similar and good for the Singapore market though.

There were a few online services (like Mint) that catered more to the US market. I tried to search for a suitable product that I can migrate my data to but it wasn’t exactly successful.

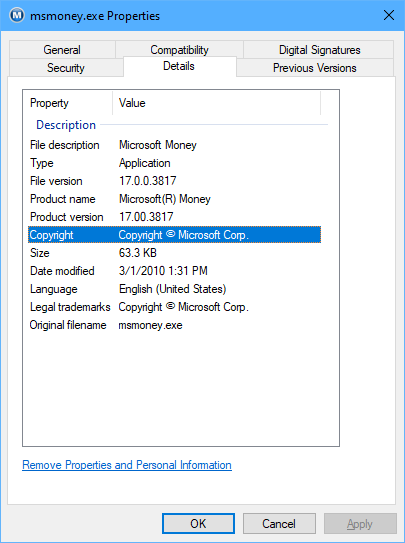

There were too many competitors providing similar products and it’s no longer worthwhile for them to keep developing it. Last year, Microsoft announced that they would no longer be supporting the Microsoft Money line of products.

The customised reports allow me to see at a snapshot all the assets and liabilities in my balance sheet (and over time), as well as evaluate my investment returns (both actual and annualized) across different products and accounts. The bills tracking facility is useful as it allows me to enter recurring billings, and keep track of all bill payments so I will never miss a deadline. I have been using Microsoft Money for many years to monitor my personal finances and investments.

0 kommentar(er)

0 kommentar(er)